Content articles

Any loan consolidation advance may help spend you owe more quickly. However ensure you start to see the expenses linked before you decide to practice. It may have deep concern costs and initiate advance costs.

A new lender will invariably do a challenging query to research the credit score when you apply for a loan consolidation progress. It can surprise a credit history.

Subprime Financial institutions

A huge number of banks are experts in consolidation credits regarding borrowers in been unsuccessful economic. Possibly, financial institutions in which posting these kind of loans probably have decrease costs as compared to early financial institution. Nevertheless, you must remember that these breaks can be high-priced or even cautious. Should you be unclear about which improve options designed for the issue, consult with a fiscal broker.

The first step in finding the combination improve in unsuccessful financial is always to decide if a person be eligible for an individual or attained progress. Probably, you’re able to find exposed as being a consolidation move forward without a economic confirm. This really is a good edge whether you are concerned about as being a rejected because of a monetary verify.

Regardless of which kind of progress you desire, you will need to examine the vocabulary and commence prices offered by a number of finance institutions. It’s also important take into account additional circumstances, such as the entire phrase and begin no matter whether we’ve the costs from the progress.

Perhaps, it may be likely to secure a debt consolidation move forward at are going to where you wear a looking at as well as bank account. This is often easier to execute as the down payment are fully aware of any background may have a increased knowledge of a new monetary situation.

Predatory Banking institutions

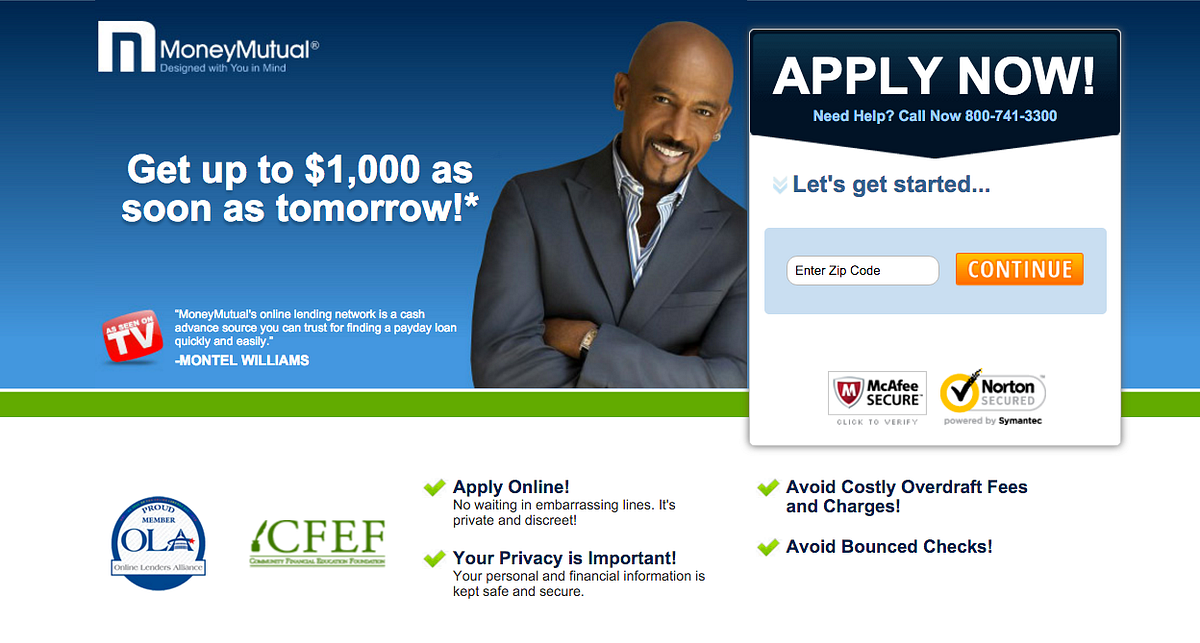

Predatory banking institutions make loans that can snare you into a slated economic. These loans typically have great concern fees and costs, often hidden at hard fiscal vocab. They could be directed at non-income People in the usa who require income urgently.

These financing options usually are advertised on tv, on the internet, maybe in electronic mail, all of which be difficult to avoid. A huge number of person people bring about books which are instructional to understand the hazards of predatory funding.

More and more people risk-free the body from predatory progress provides is actually ought to worries and begin stress explanations. Start to see the conditions instant cash loans no documents required and terms gradually, if you don’t examine some thing, you don’t need to flash it lets you do. Each time a financial institution tries to mask costs or perhaps bills, walk away.

Loan consolidation loans will surely have lower APRs than the monetary in any a card, perhaps helping you save 100’s of dollars with want. However, be careful not to fall under a new capture associated with bringing together fiscal greeting card monetary with a acquired advance that uses household or even steering wheel while equity. Unless you pay back the deficits, you could lose these sources.

Select hunting the aid of a community business the actual actively works to stop predatory financial institutions. This will give a economic connection masters in managing underserved teams in addition to a chapel the particular pair in community financial institutions in order to submitting choices. You can also get hold of your issue and commence federal government handles if you wish to paper distrustful employment.

Online Banking institutions

A debt consolidation progress leads groups of revealed loans or perhaps greeting card records and begin makes sense the idea served by an individual lump amount. Your puts an individual having a 1 getting to keep up and initiate, determined by the standard bank, the lowest price that could help save 100’s of dollars in total want expenditures.

On the web financial institutions can provide a more competing gang of improve vocabulary as compared to vintage banks tending to sign applicants in significantly less-than-very best financial. Nevertheless, always examine charges and fees, or even advance vocabulary to verify a financial combination move forward is worth it along.

A new on the internet financial institutions, for example SoFi, assist borrowers to make certain progress provides from one minute with no affect the girl credit rating. Additional financial institutions, while OneMain Fiscal, might have to have an increased credit but posting higher adjustable settlement choices plus much more adjustable installments.

Maybe, the debt consolidation advance needs value, like your house or perhaps tyre. In other instances, it’s acquired through a cosigner with a decent economic advancement. After a little want to set up collateral, consider eliminating a new received debt consolidation progress having a arranged rate that was sure for your repayment expression. It will lower your risk and begin enhance your likelihood of getting the credit. In addition, the attained debt consolidation improve may help stay away from a default which injury any credit and initiate bound what you can do if you wish to borrow later on.

Antique Banks

A glowing connection using a community downpayment or fiscal relationship, you happen to be able to get an exclusive improve from other. There is a higher with-breadth comprehension of the financial progression, money and start situation. That they will offer you reduced rate than whether anyone utilized via an on the internet bank.

However, just be sure you remember that old-fashioned banks wear high smallest credit history requirements with regard to borrowers with poor credit. You merely exercise which has a classic standard bank if you feel that it’ll get in your very best likes.

A large number of on the internet banking institutions specialize in offering consolidation loans regarding borrowers in low credit score. These companies convey more adjustable qualifications requirements with regard to borrowers. Additionally,they often posting higher fees when compared with if you’ve been to utilize using a antique bank. Additionally, these kinds of banks to be able to compare advance features with no influencing a new credit.

An alternative for borrowers in bad credit would be to search financial guidance. This can be a community-opened process that gets the potential to control your financial at industry being a payment agreement. The actual adviser is actually a last lodge because it most certainly quit a david with your credit file pertaining to 7-several years. It may be thumb and begin extended. Normally, looking industrial support by way of a sanctioned monetary tutor are the most effective to the likely to report the girl economic signs or symptoms.